32+ How much on a mortgage can i get

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Estimate How Much Home You Can Afford and Prequalify for Your Mortgage Today.

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. Therefore if you can somehow find a way to get a primary residence mortgage versus a rental property or vacation property mortgage your terms will be more favorable. It is a comparison of the average advertised Big 6 bank special offer rate versus.

To understand how this works lets take the example below. If you have an income of 100000 you can consider homes priced up to 500000. If youre serious about buying a home you need to get pre-approved for a mortgage.

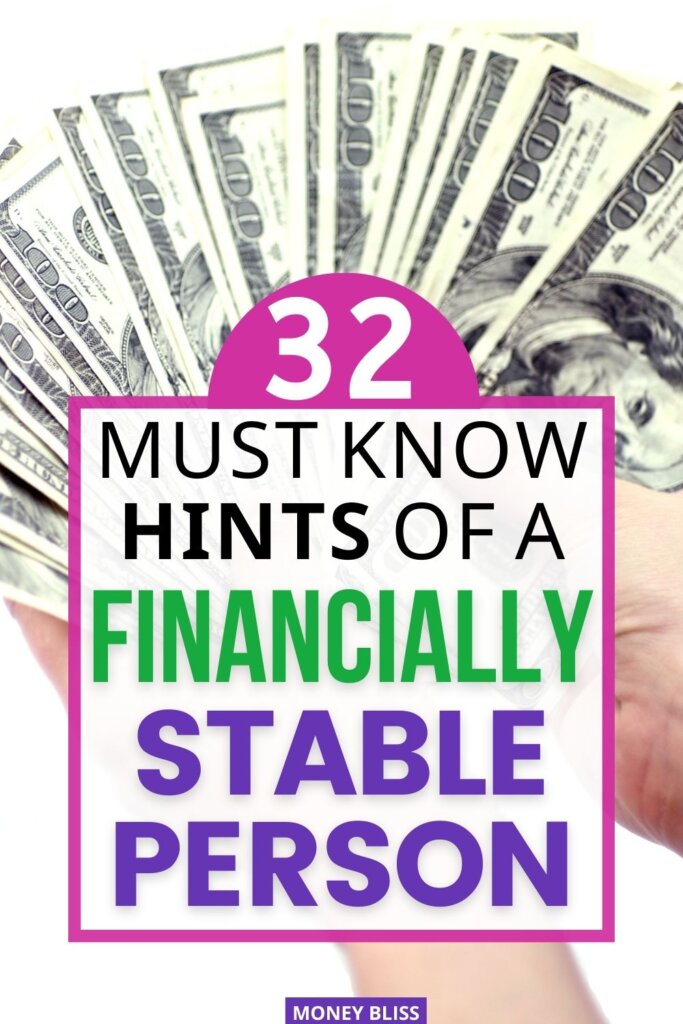

Your total interest on a 1000000 mortgage. 1 the average discounted discretionary rate at the Big 6 banks as tracked by Butler Mortgage 2 the average broker rate as tracked by MortgageDashboardca and 3 the lowest conventional full-featured 5-year fixed rate at Butler Mortgage as of March 14 2017. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

I normally see vacation property loan-to-value ratios of 30 and up in order to get a mortgage. Savings is over five years. Before applying for a mortgage you can use our calculator above.

No more than 30 to 32 of your gross annual income should go to mortgage expenses such as principal interest property taxes heating costs and condo fees. Loans geared toward borrowers in rural markets with incomes below 115 of the local median income. Top backend limit rises to 44 with PITI below 32.

A small funding fee of about. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. Chances are your new home will be larger than your current space and therefore your utility costs will probably go up.

2022 USDA mortgage May 17 2022. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator. Typically lenders cap the mortgage at 28 percent of your monthly income.

Dont forget that your mortgage and existing debts wont be the only bills youll need to pay. Thats about two-thirds of what you borrowed in interest. The longer term will provide a more affordable monthly.

18001 0800 096 9527. This looks at how much you make in proportion to how much the mortgage will cost you each month including extras like private mortgage insurance homeowners insurance and property taxes. Can you get a mortgage if you have bad credit.

This provides a ballpark estimate of the required minimum income to afford a home. Your total interest on a 250000 mortgage. Between 29 to 32 Can be higher with compensating factors.

Thats about two-thirds of what you borrowed in interest. 0800 096 9527 Relay UK. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

8 Ways To Get A Mortgage Approved And Not Mess It Up May 26 2016 4 ways to keep your mortgage closing costs low June 22 2017 USDA eligibility and income limits. With certain loan programs and lenders it may be possibleespecially if you can make a big down payment prove large cash reserves and have a low. How long will I live in this home.

Should not exceed 41. You can get in touch over the phone or visit us in branch. TDS looks at the gross annual income needed for all debt payments like your house credit cards personal loans and car loan.

Vacation property mortgage interest rates are generally 05 higher as well. Learn what is required so you can speed up the approval process. Total Debt Service TDS Ratio.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year. If this is the maximum conforming limit in your area and your loan is worth 600000 your mortgage can be sold into the secondary market as a conventional loan. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Getting a Mortgage When.

Rhonda Jenkins Sr Loan Officer 246519 Securitynational Mortgage Company 3116 Linkedin

How To Pick A Mortgage Loan Term

Prospect Home Loans

Sample Notary Letter 32 Notarized Letter Templates Pdf Doc Free Premium Templates By Www Template N Letter Templates Lettering Statement Template

Mortgage Note 6 Examples Format Pdf Examples

How To Pick A Mortgage Loan Term

Three Main Needs Of The Employee Verification Letter You All Need To Know About Letter Of Employment Lettering How To Find Out

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

Three Main Needs Of The Employee Verification Letter You All Need To Know About Letter Of Employment Lettering How To Find Out

Jessica Longtine Er Home Facebook

2

32 Responsive Landing Page Themes Templates Free Premium Templates

32 Free 32 Free Cohabitation Agreement Templates Printable Samples

Assuming A Mortgage After Divorce Unhappy Marriage

Fred Saboori Home Mortgage Consultant Firestone Financial Group Linkedin

22 Corporate Flyer Templates Psd Ai Apple Pages Word Indesign Publisher Free Premium Templates

Abdul Latif Seidu Associate Cloud Architect Go Cloud Careers Linkedin