24+ Paying extra on mortgage

As we showed in our example above 100 a. Enter your loan information and find out if it makes sense to add additional payments each month.

Mortgage Payment Coloring Printable Tracker 30 Year Journal Page Chart Visual Goal Financial

The remaining term of the loan is 24 years and 4 months.

. It doesnt sound like much but even 100 a month toward your principal can knock money off your principal balance and lower your interest paid. What happens if I pay an extra 1000 a month on my mortgage. Assuming youve got a 100000 loan amount set at 4 on a 30-year fixed mortgage that extra 10 payment would save you 319181 over the full loan term.

Go ahead and play with the table by typing some values in the Extra payment column. Pay an Extra 100 a Month. There are many ways to make an extra mortgage payment.

To be more precise itd shave nearly 12 and a half years off the loan term. Ways to Make an Extra Mortgage Payment. By paying extra 50000 per month the loan will be paid off in 14 years and 4 months.

Closing Balance is opening balance minus principal paid minus extra payment. You can see the effective term reducing. Now lets say you invested that extra 188 every month instead and you averaged a 7 annual return.

Adding an Extra Mortgage Payment of 10 Per Month. Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half. However if this same homeowner were to make one extra mortgage payment every year the borrower will have paid off the loan in 26 years versus 30 years.

Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. In 20 years youd have earned 510005000 ahead of the sum you saved in intereston the funds you contributed.

Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. Pay 948 a month188 moreand youll pay off the mortgage in 20 years and youd save 46000 in interest. The total interest expense this homeowner would have paid over the course of this loan term would have been 153813 versus 186512.

You will pay 23313389 in interest over the course of the loan. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. How Much Interest Can You Save By Increasing Your Mortgage Payment.

The result is a home that is free and clear much faster and tremendous savings that can rarely be beat. This translates into a savings of 32699. Here are the most popular ways.

Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Home financial. In this scenario an extra principal payment of 100 per month can shorten your mortgage term by nearly 5 years saving over 25000 in interest payments.

Your mortgage will end when the Eff. Complete this table with necessary formulas and fill everything down. If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each month in principal and interest alone.

A 225000 loan amount with a 30-year term at an interest rate of 3875 with a down payment of 20 would result in an estimated. It would also shorten your mortgage by. Conforming fixed-rate estimated monthly payment and APR example.

Or if you get a bit of money say a 5000 tax refund you could apply it to your. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. To be more precise itd shave nearly 12 and a half years off the loan term.

If youre able to make 200 in extra principal payments each month you could shorten your mortgage term by eight years and save over 43000 in interest. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Lets start with a simple scenario where you add just 10 a month in extra payment to principal.

Mortgage Calculator With Extra Payments. The result is a home that is free and clear much faster and tremendous. For example if you pay 1300 per month normally you may pay an extra 200 to the principal for a total payment of 1500.

Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half.

Refinance A Loan Advance America

Free 15 Loan Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

Should I Pay Extra Each Month I Pay Mortgage Payment Paying

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Should I Pay Off My Loan Early Advance America

Payment Reminder Email How To Write 24 Samples

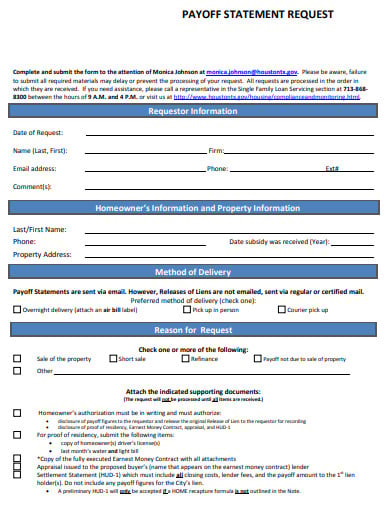

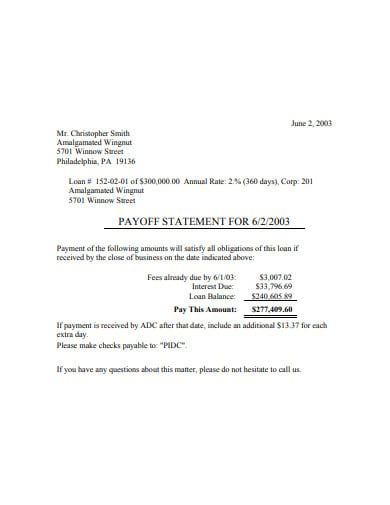

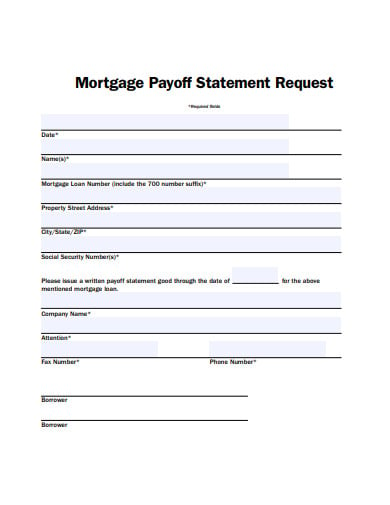

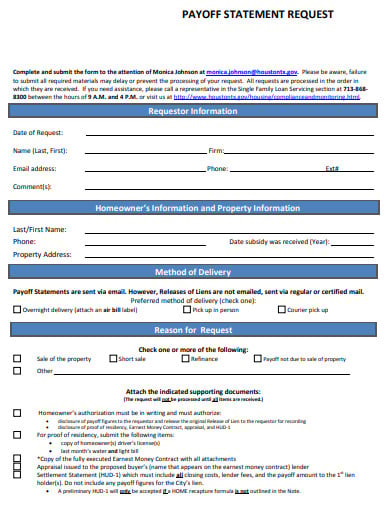

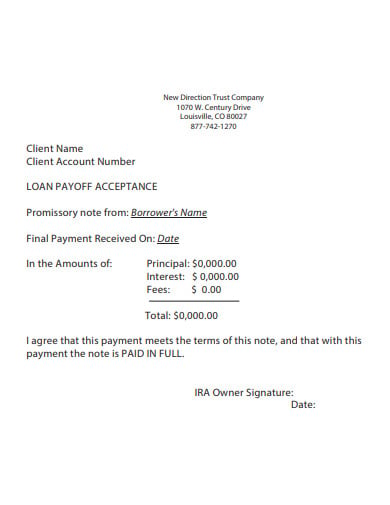

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Payoff Statement Templates In Pdf Free Premium Templates

How To Get Out Of Debt Pay Off Debt Or Save Advance America

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Early Mortgage Payoff Calculator Mls Mortgage Mortgage Payoff Amortization Schedule Mortgage Refinance Calculator

The Best Mortgage Calculator With Extra Payments Mortgage Calculator Mortgage Tips Mortgage

What Is Financial Literacy Advance America

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Payoff Statement Templates In Pdf Free Premium Templates

Debt To Income Ratio Advance America